For me as a financial advisor it is very important that our clients generate long-term assets in any form. This building up deals with financial independence.

What it is long-term assets and how to get there?

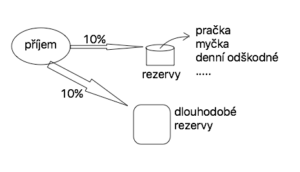

The first phase is always to ensure the most important and that is the basic financial reserve. Thanks to it, one is able to financially withstand the unpredictable and financially challenging life situations. Provision should be at least 3 monthly necessary expenses, ideally 6 monthly household income. We call this type of a reserve a short-term reserve.

Any savings above this limit unnecessarily lose their value and it is necessary to work with them and also constitute a medium and long term reserve.

Medium-term reserve can be imagined as money that you currently do not need, but will utilize it throughout your life until the phase of annuities. If you have a family, so the medium-term finance will pay the study for your children, support for their start in life, or renewal of the fleet, dream holidays and so on.

By long-term reserve I mean, for example, to ensure a peaceful and dignified old age, so you are not dependent on the state pension and could not afford what you want. Everything is always the question of preparation and we can manage it with a minimal amount of expended energy. In the ideal case, there is a rule of putting 20 % of your revenue aside. 10 % of this goes to short-term reserves and the remaining 10 % to the long term.