What Bitcoin and a Canadian pot grower have in common

I should be happy these days. For a long time, I’ve argued that cryptocurrencies are a fad that speculators will eventually get their teeth into.

My argument has always been this:

-

When something has been highly popular in the past, it has not usually ended well. Throughout history, we have seen a recurring pattern of “boom and bust”.

-

Many think they will sell in time. However, historical bubbles show us that this is just wishful thinking. Investors and speculators are surprised time and time again by the speed of events. The stock market crash in October 1987, the bursting of the dot.com bubble in 2000, the bursting of the real estate bubble after 2007. These are just a few examples.

-

We have no idea what Bitcoin is worth. Is it $10,000 or just $10? Same with other cryptocurrencies. For example, with stocks, we can estimate the value: companies have profits, dividends, cash flow. But how do you estimate the value of cryptocurrencies? You can’t.

-

Cryptocurrencies are an unregulated market. And in an unregulated market, nasty things happen, from price manipulation to Ponzi schemes. Fraudsters have their hands free.

-

Cryptocurrencies are supposedly attractive because they are in limited supply. But there is a big hitch in this claim. There are unlimited amounts of cryptocurrencies themselves. Just look at the list. Yes, there are nearly two thousand. That’s what we call pretty good inflation.

Many have not taken these arguments seriously. For example, one client called me a dinosaur (he may actually have been right). The other couldn’t understand why I’m throwing myself into the stock market, where I have to wait sometimes years for returns. When high returns are so easily attainable, and for everyone.

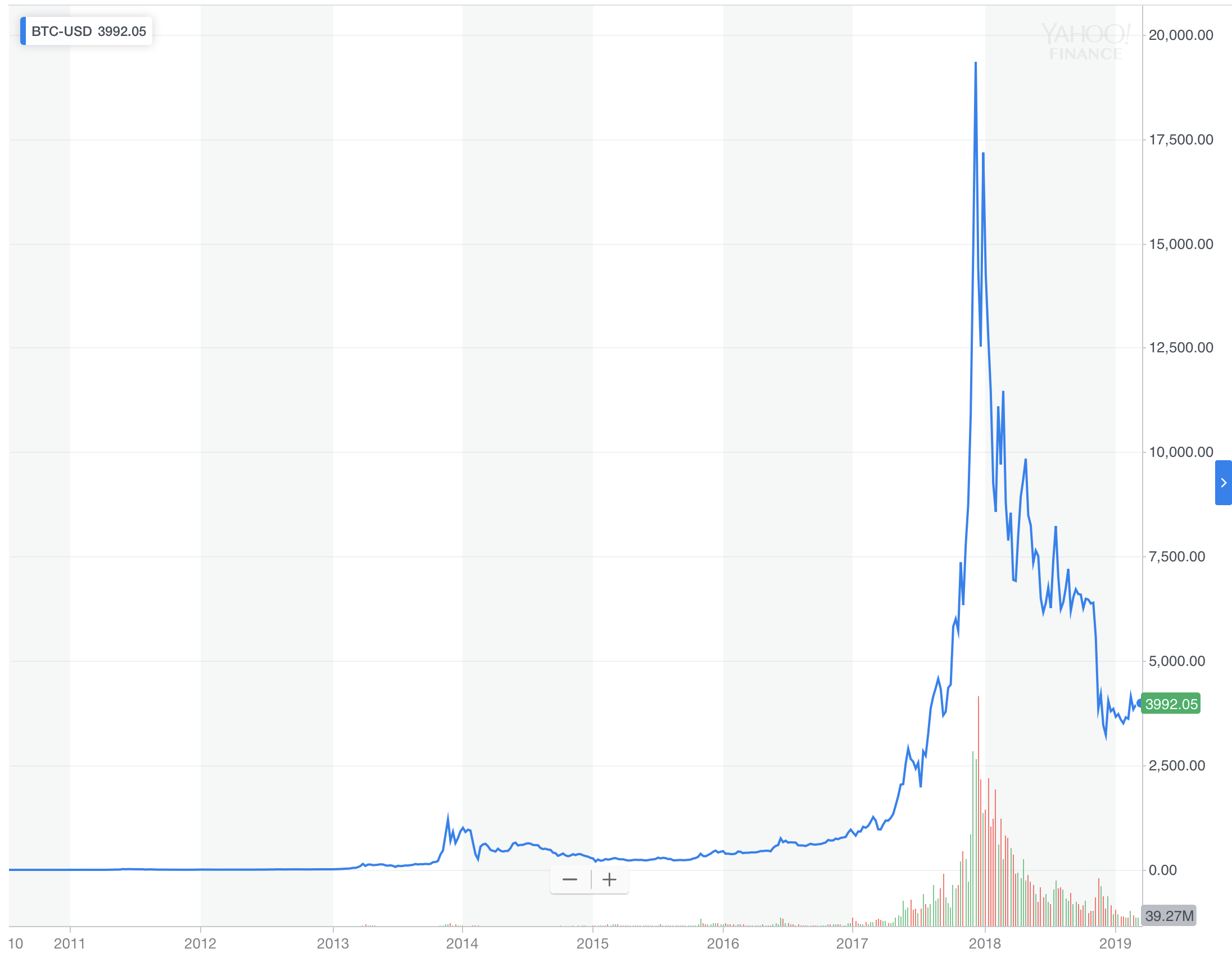

Although the crash did occur, I have no reason to celebrate. When I read all the horrible stories, the financial tragedies, it doesn’t make me happy. Like Sean Russell, who lost almost all his life savings. In November 2017, he plunged $120,000 into bitcoin. His status after just one month? $500,000. Sean was in seventh heaven then. In his words, “I thought, wow, this is going to pay my mortgage and all those vacations I’ve always dreamed of.“. But soon, the hard reality set in. Bitcoin went bust and Sean tried to mitigate his losses by buying other cryptocurrencies. In the end, he lost 96% of his capital. The full story can be found at this link.

Below is a chart of Bitcon’s development on the exchange.

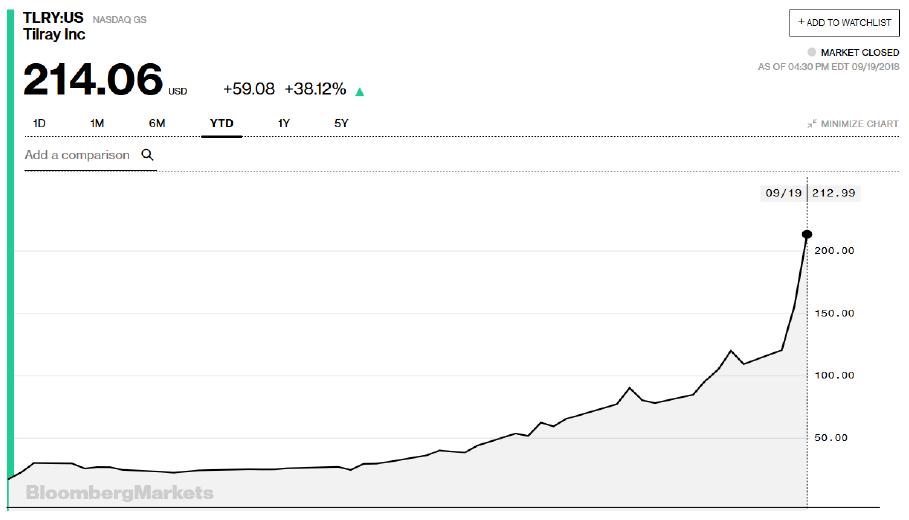

Sean is far from alone. You may have heard Einstein’s definition of insanity somewhere: “Doing the same thing over and over again and expecting different results.” Einstein was right, of course, people obviously have a special talent for it. Time and again, they pounce on “hot stuff” and various “companies and sectors of the future” in pursuit of quick and effortless profits. The current “hot” thing is electric mobility or Tilray, the Canadian medical marijuana grower (see chart below).

So shop fast and ride the next mania. Maybe it’ll work this time, you just need to sell on time. Einstein wasn’t a genius too, was he?